FOCUS – 2020 News

Keep up to speed with us!

FOCUS – EXPO 2021

Dubai’s international trade event has come with new dates for next year. The government initiatives are promoting many international buyers to invest in prime locations. There will be an honest increase in the number of visitors with an agenda to expand the business. EXPO 2021 will emerge as in emotion for owning property in UAE and we will be excited to welcome more cultures and visitors to our beloved home.

The major investment hotspots of the world need annual property tax filing indeed, adding to the cost of investment. Whereas in the U.A.E. there is 0 percent tax imposed on the property, making the U.A.E. an ideal place to buy a property.

Dubai’s long-term growth plans were never based solely on the success of Expo2020. The exhibition has always been a part of a broader five-year plan. Although the legacy of Expo 2020 is hard to estimate, the investment climate remains positive with infrastructure upgrades. In 2019, the UAE has attracted $12.7b in foreign direct investment in H1, an increase of 135% year on year – while tourist arrivals rose 3% in the same period to reach 8.4m. A short-term outlook was never intended to sustain long term success.

FOCUS – RETAIL REAL ESTATE

There is a thirst for shopping and the U.A.E. has accelerated recovery from the pandemic. According to DSC data, the retail and wholesale sector acquired 25.5% of Dubai GDP through the first half of 2019 which is worth of AED 53.042 billion out of the total AED 208.21 billion. GDP in the U.A.E. is expected to reach 431.00 USD Billion by the end of 2020, according to Trading Economics global macro models and analytics expectations. Dubai’s retail market is set to change drastically over the next five year with over 3.7 million square meters of retail space set to be delivered by 2024. If the delivery of this supply come to fruition, we expect Dubai’s total retail stock to be almost 7.1 million square meters, a 111% increase on current levels.

By 2022 we are likely to see the delivery of over 650,000 square meters of retail space, the vast majority of which will be in the form of super regional or regional malls. Many of these new offerings will be destination and entertainment focused, so are likely to attract significant demand, as currently existing offerings lack this element, therefore these developments are likely to be most adversely impacted in the long term. Banks have helped stimulate the market through low-interest rates and longer-term payment plans and will keep the retail sector thriving. Both the Federal and Dubai governments announced expansionary budgets for 2020.

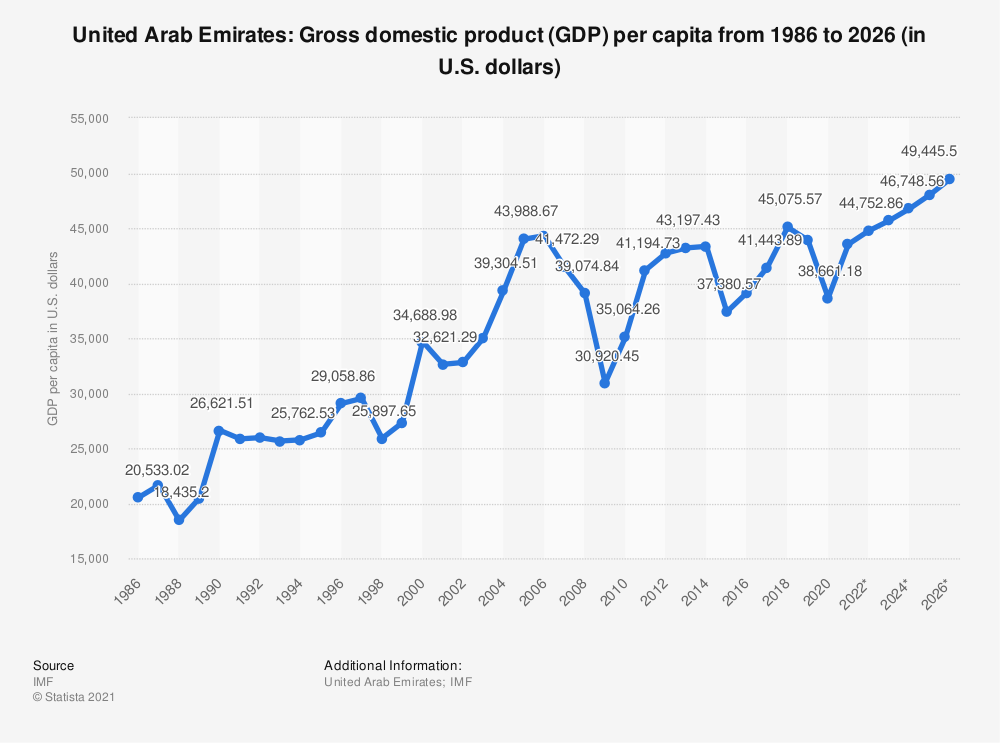

FOCUS – GDP U.A.E.

Looking ahead, the U.A.E.’s GDP is expected to pick up momentum and record a growth rate of 2.2% in 2020, before tapering slightly to 2.1% in 2021. Expo 2020, existing stimulus packages and expansionary budgets are set to underpin these stronger rates of growth. In Dubai, over the five years to 2025 retail stock is expected to increase by 56% to 5.91 million square meters, from 3.46 million square meters as at Q4 2019.

First and importantly for Dubai, there have been a range of measures announced by the government to help balance supply and demand in Dubai. His Highness Sheikh Mohammed bin Rashid Al Maktoum, the Vice President and Prime Minister of the U.A.E. and Ruler of Dubai, has instructed for the creation of a higher committee to undertake the development of a comprehensive and strategic plan for all of Dubai’s upcoming real estate projects.

To help in executing this, we have seen regulatory changes to Dubai’s Real Estate Regulatory Agency (RERA). As one of RERA’s objectives is now to contribute to the development of the real estate sector and enhance its contribution to the wider economy, coupled with the creation of a higher committee, this latest development is likely to help contribute to and enforce more thought-out developments and communities.

This in turn will enhance long-term confidence from developers and investors. More so, in 2019 a range of regulatory changes came into play, including the announcement of 100% onshore business ownership, easing of visa regulations, the introduction of the golden card residency scheme and Abu Dhabi’s freehold ownership law. These measures are likely to drive additional demand to the U.A.E.’s property market, particularly given that many of the changes in visa regulations are linked to property ownership.

Interest rate cuts by the U.A.E. Central Bank have also led to a fall in the cost of borrowing, where the six-month EIBOR rate has fallen from highs of 3.14% to 2.01% in 2019. This alongside reforms in banking regulations relating to real estate lending may provide greater access to cheaper financing options, thereby encouraging activity in the UAE’s residential sector.

In addition, Dubai launched an AED1.5bn economic stimulus package for the next three months to support businesses by reducing costs and simplifying procedures, targeting tourism, retail, trade and logistics sectors. Abu Dhabi announced an AED3 billion package for reducing fees and providing credit guarantees to SMEs. The Central Bank announced a package of US$25 billion to boost financial system liquidity.

More so, the US Dollar, to which the Dirham is pegged, registered strong growth from May 2014 to December 2016; this has proved to be a strong headwind for the U.A.E.’s economy and its retail sector, particularly for tourism spending. From January 2018 to December 2019 we have seen the Dirham strengthen again by 5.8%. This is another key factor, which is exerting pressure on retail assets in the U.A.E. These trends have meant that on average rental rates across the U.A.E.’s retail market have softened considerably. Non-prime assets in secondary locations have seen significant double-digit declines. Prime assets in prime locations, which have significant demand drivers, have seen low single digit to low double-digit declines in rental rates over the course of 2019.